Lenders and organizations are recognizing the worth in Operating together to help more people. Via platforms which include Acorn Finance, you'll be able to Verify prices and Look at loan provides from a community of top rated nationwide lenders.

The tax experts consulted for this information universally assigned the highest amount of certainty to hard cash invested to accumulate an asset. The around $94 million that Mr. Trump’s tax returns demonstrate he invested in Chicago fell into this classification.

There are several classes, with a declining likelihood of achievements, of money taxpayers can assert to get missing.

Jordan Tarver has spent 7 years masking home loan, private loan and business enterprise loan articles for leading financial publications such as Forbes Advisor. He blends awareness from his bachelor's degree in company finance, his knowledge as a top rated performer while in the home loan market and his entrepreneurial good results to simplify intricate financial subject areas. Jordan aims to make mortgages and loans comprehensible.

Mr. Trump’s worthlessness claim meant only that his stake in 401 Mezz Undertaking, the L.L.C. that held the tower, was without having worth mainly because he anticipated that gross sales would hardly ever deliver ample cash to pay back the home loans, not to mention switch a financial gain.

Prosper was the primary lender to offer peer-to-peer loans, which Provide you with extra prospects for approval than a conventional lender. Co-borrowers are permitted and competent borrowers could possibly get costs below 9 p.c.

Acorn Finance is one hundred% free of charge to borrowers and contractors. In case you are a contractor searching to provide an affordable payment Alternative for purchasers you ought to Get in touch with Acorn Finance.

Having said that, in most cases applying Acorn Finance or an internet based lender may help simplify the personal loan system even though ensuring that you have a aggressive interest fee, irrespective of your credit rating.

Quite a few customer loans slide into this classification of loans which have normal payments that check here are amortized uniformly in excess of their life time. Regime payments are created on principal and curiosity right until the loan reaches maturity (is completely compensated off). A lot of the most acquainted amortized loans consist of mortgages, motor vehicle loans, college student loans, and personal loans.

Right before using out a superior-fascination loan, look at your other available choices. These may well incorporate acquiring a cosigner for just a reduced fascination loan or acquiring a secured loan in which you use collateral that can assist you have the loan you will need.

The worthlessness deduction serves as a way for just a taxpayer to get pleasure from an anticipated full reduction on an investment very long before the last success are acknowledged. It occupies a fuzzy and counterintuitive slice of tax regulation. Three a long time back, a federal appeals court ruled which the judgment of an organization’s worthlessness may very well be based in section around the feeling of its owner.

Your genuine desire level and APR will rely upon aspects like credit history rating, requested funding total, and credit score heritage. Only borrowers with superb credit rating will qualify for the bottom price. Presents symbolize most affordable monthly payment for volume and time period displayed. When evaluating delivers, please assessment the funding lover’s terms and conditions for additional facts. All loans along with other money products are topic to credit score overview and acceptance by our companions.

Russ Buettner can be an investigative reporter. Since 2016, his reporting has centered on the funds of Donald. J. Trump, which include article content that exposed tax avoidance strategies evidenced on many a long time of his tax returns.

Editorial Notice: We generate a commission from partner hyperlinks on Forbes Advisor. Commissions do not impact our editors' opinions or evaluations. Own loans are a variety of financing borrowers may get from conventional banking companies, credit rating unions or on the internet lenders, by which they get a lump-sum payment they could use for just about any lawful private expense.

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Robbie Rist Then & Now!

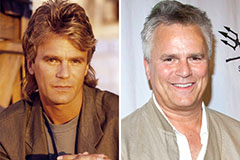

Robbie Rist Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!